Schedule an Commercial Banking Assessment.

It Could Save Your Business Money Each Month.

About our Expansion to

North Atlanta

Cumming Ga. - Released 2019

Affinity Bank, a metro Atlanta bank with nearly 20 years of experience propelling organizations to success, is anchoring a team of experts in the heart of North Atlanta.

Based near Avalon, Alpharetta’s thriving retail, restaurant and business community, Affinity Bank’s team will be led by long-time Northside influencer Carter Barrett and Andrew Bell, a banking expert with strong roots in the area’s business community.

“We couldn’t ask for a better team to serve North Atlanta business owners,” says Ed Cooney, President of Affinity Bank. “Together, Carter Barrett and Andrew Bell represent one of the most well-connected, well-informed consulting teams in North Fulton and beyond.”

Carter Barrett, Affinity Bank’s Market President for the North Atlanta division, is a commercial banker with … read more >>

3 Factors Come into Play

The average sale price for a healthy practice in your market area.

The bank’s tolerance for risk at any given time.

The profit margins of the practice and its ability to consistently generate sufficient cash flow to pay it current and future debts.

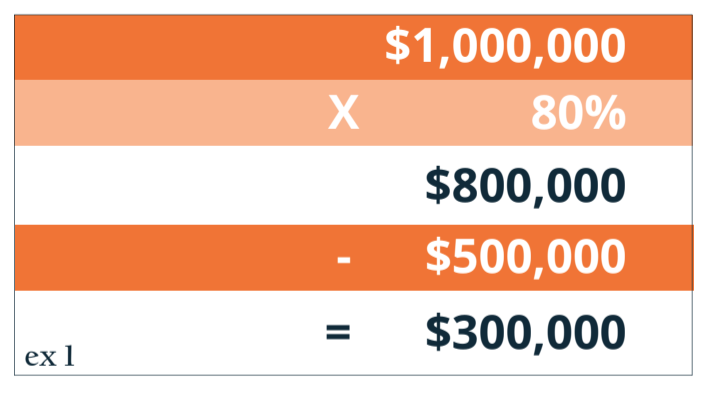

Here's a Hypothetical Example

A practice averages $1 million a year in collections over the last three years. Further, in the designated market area, the average sale price has been about 80 percent of average annual collections. Finally, let’s assume an existing debt of $500,000.

The formula for potential “lendable practice equity” is the average collections of the practice multiplied by the regional sale-price-to collections ratio minus the debt of the practice.

For this example: $1 million times 80 percent = $800,000 minus $500,000 = $300,000 (ex 1). Keep in mind that the lendable practice equity is only one factor in the decision. Also considered are the practice’s profit margins and its ability to generate enough cash to cover existing and future debts.

Lending to a homeowner is easy.

You simply determine the market value of the home and calculate the size of the loan accordingly.

But a dental practice is different. There are few tangible assets. Most of the value is in the goodwill –– the hard work, sweat and tears the dentists have put into the practice to build its reputation on the market. But it’s hard to value goodwill, and even harder to use it as collateral for a loan. Fortunately, about 85 percent of Affinity Bank’s clients are dentists, so we’ve long since figured out how to value a practice.

Make the Switch

As the Leading Dental Bank in the Southeast, Our Client Service Team Knows How to Impact Your Practice - Increase Your Return

For decades Affinity Bank has served the dental community and we have helped our dentists succeed. For instance, it’s been our practice to leverage your practice equity in underwriting your efforts to purchase new equipment, renovate your office, pay off student loans or buy into a practice.

READY WHEN YOU ARE. To schedule a commercial account analysis, move your commercial accounts, or apply for a loan — Contact a Banker client at Affinity Bank.

Our Home Loans

Home Mortgage Loans

Purchase or refinance your home with customized terms and a local decision.

Since our founding, we’ve worked to make home ownership affordable for the communities we serve. That mission continues to this day with our competitive-rate home mortgage loans.

Because we’re here in Covington, our lenders are familiar with the local real estate market. We’ll work closely with you, and establish terms tailored to your situation. Choose from a variety of options, and finance your dream home today.

If a traditional home mortgage is out of your reach — don’t despair. You may be eligible for a government-backed loan with unique benefits. We offer an array of options for veterans, first-time buyers, and more.

- For homebuyers looking for their main home or alternative financing

- May qualify for the lowest mortgage rates

- Competitive rates for home purchase and refinance

- Flexible terms tailored to your situation

- Pre-qualification available

- All primary home mortgage decisions made locally

- Experienced lenders with knowledge of the local real estate market

Visit our Mortgage Center to learn more about the home financing options we offer.

We offer a variety of financing options to meet your home mortgage loan needs. Speak to one of our friendly mortgage professionals to determine which loan option may be right for you — contact us today.

- Fixed rate mortgages

- Second mortgages

- Renewable mortgages

- Fixed-rate jumbo loans

- Conventional loans

- These loans usually require a low down payment of your own funds to purchase a home. However, for any conventional loan with less than 20% down, you will be subject to mortgage insurance on the loan. There are a couple of ways that the mortgage insurance can be paid. It can be a monthly charge on the loan or you can pay it in a lump sum upfront. The upfront lump sum can be a great option if you are purchasing a home and the seller is covering your closing costs.

- FHA loans

- FHA loans have been helping people become homeowners since 1934. The Federal Housing Administration (FHA) — which is part of HUD — insures the loan, so your lender can offer you a better deal. With low down payments, low closing costs, and easy credit qualifying, an FHA loan may be right for you. Ideal for first-time homebuyers, or buyers with limited fund.

- VA loans

- With no down payment required, eligible veterans, active-duty personnel, national guard and surviving spouses can purchase or refinance a home. In addition, private mortgage insurance is not required. With a Certificate of Eligibility from the Department of Veterans Affairs, you can purchase or refinance a home with limited closing costs and flexible credit criteria. Up to 100% financing for veterans of the U.S. Military.

- USDA loans

Are you ready to own a home but concerned you won’t qualify because of the down payment? Rural Development may be able to help you. USDA (Rural Development) has partnered with local lenders to help them extend 100% financing opportunities to individuals and families.

- Loan programs that avoid PMI, with no rate increase for those who qualify

Business Banking For the Win

Set your business up to win. Move your company’s accounts over today. We successfully helped thousands get through PPP without a scratch. Mega institutional banks can’t say the same thing.

MoneyIQ Financial Education

We provide businesses with the tools to educate their staff about money. Topics include basic banking tips, cashflow management and identity theft prevention.

Online Banking Done Right

Our online banking tools for personal or business banking makes life easier. Ask your Newton Federal banker about setting up a branch office on your smart phone.

Home Mortgages Made Easy

It’s All About Your Pad. Find a mortgage that fits your family’s needs at LeapFrogMortgage – our new home lending partner.

Dental Organizations We Support

Dental Advisory Board

Meet Leaders in the Southeast Dental Community

who Honor Our Efforts by Providing Industry Insights

as Members of the 2020-2021 Dental Advisory Board

Dr. Zachary Powell

Redfern Dentistry in St Simons

Powell Dentistry in Redfern is located in charming Redfern Village on beautiful Saint Simons Island, Georgia.

Dr. Kaneta Lott

Family and Children’s Dentistry in Atlanta

Practices at Family and Children’s Dentistry, and lectures nationally on Pediatric Dentistry and Dental Traumatology.

Dr. Robin Reich

Reich Dental Center in Smyrna & Roswell

Practicing since 1984. Attended the University of Michigan and received her D.D.S. from the University Of Detroit School Of Dentistry.

Dr. Frank Clayton

Clayton Dental • Village Grove in Suwanee

Internationally recognized lecturer, author and clinician. Served patients for nearly 2 decades after graduating from the University of Georgia and the University of North Carolina’s School of Dentistry.